How Did Oregon Schools Become So Underfunded?

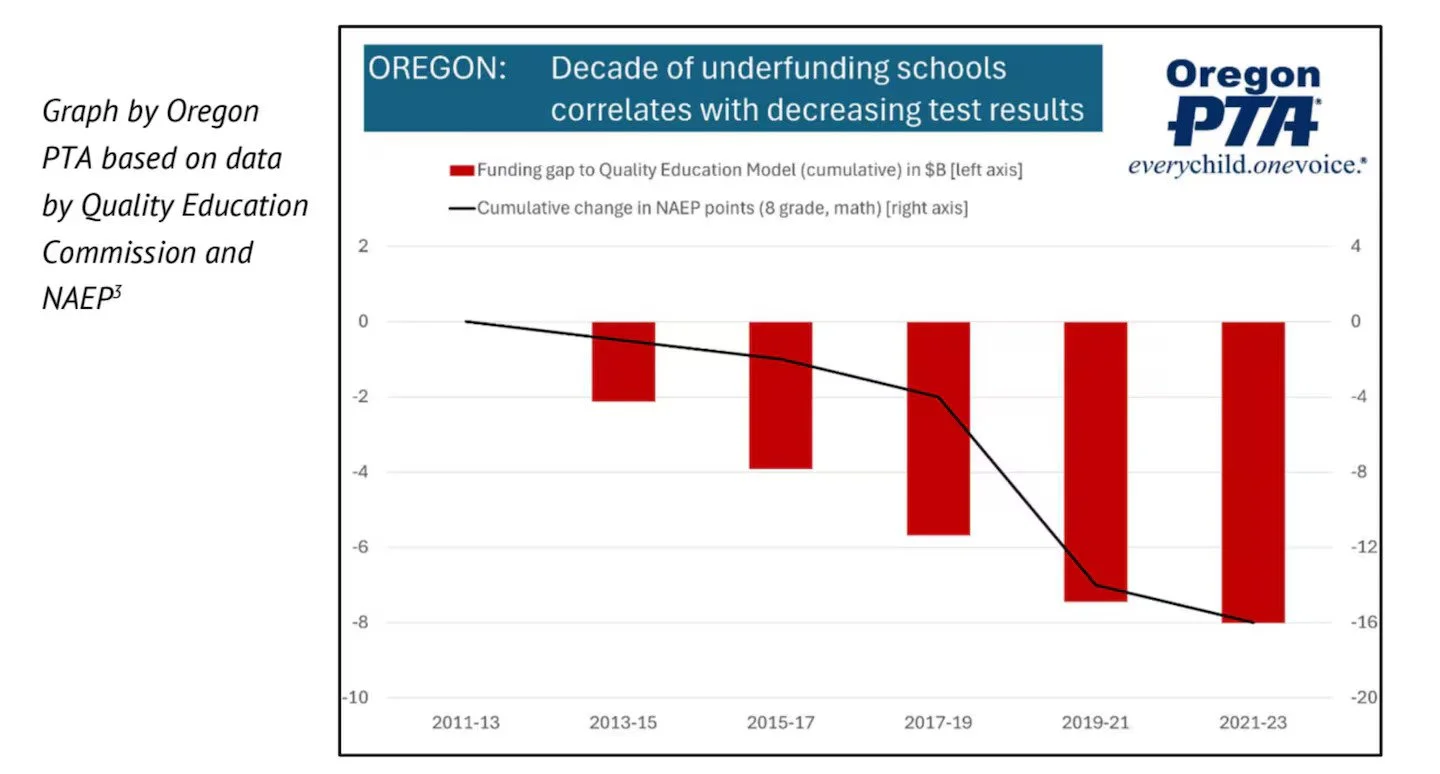

Oregon hasn’t adequately funded education in over 30 years and year after year we're falling short by over 1 BILLION dollars.

In 1990, Oregon voters passed Measure 5, limiting local property taxes and forcing the state to make up the difference in school funding. Then in 1997, voters passed Measure 50, which rolled back tax assessments and prohibited future tax rate increases.

And it makes sense, right – who wouldn’t vote to limit their taxes if they were told school funding would be protected? But today, we’re seeing the disastrous impacts of this short-sighted policy. In just the first sixteen years, Measure 5 and Measure 50 reduced local revenues by $41 billion.

The proportion of K-12 operating expenses funded by the state skyrocketed from 29 percent in 1990 to 71 percent in 1998.

Since then, we’ve seen test scores drop as the funding gap grows.

With inflation, rising energy costs, and enormous classroom needs, the last state education budget resulted in a decrease to the state’s overall education service level. If that’s really the best our legislators can do with our current tax system, it’s clear we need to fix the system.